The market has always been fickle, and you never know what will happen next. At this time last year, the highly prosperous semiconductor market environment led Bloomberg to predict that over the next decade, more than $700 billion would be invested in the semiconductor field globally. However, just one year later, the Economic Daily reported that ten semiconductor giants have slashed their capital expenditures, totaling nearly NT$600 billion, marking the largest capital expenditure correction in the history of the semiconductor industry.

Even though they are in the same time period, the semiconductor market of last year and this year shows two completely different situations. At present, to cope with the pressure brought by the downturn, reducing capital expenditure seems to have become a "defense" measure for large factories. However, there are also "rebellious" expanders who, in the face of high inflation and an uncertain economic situation, still choose to expand against the trend.

Semiconductor materials, the eternal winner?

Semiconductor materials and equipment, as the most upstream industry in the semiconductor industry chain, belong to the supporting industry of chip manufacturing and testing, and are often called the "shovel seller" of the entire industry, which is the field that really makes money. However, the recent decline in demand, the halved market value, the waning enthusiasm, and the reduced capital seem to indicate that the days of semiconductor equipment manufacturers are far from as good as they used to be. In contrast, silicon wafer and SiC substrate manufacturers are still expanding production vigorously.

Advertisement

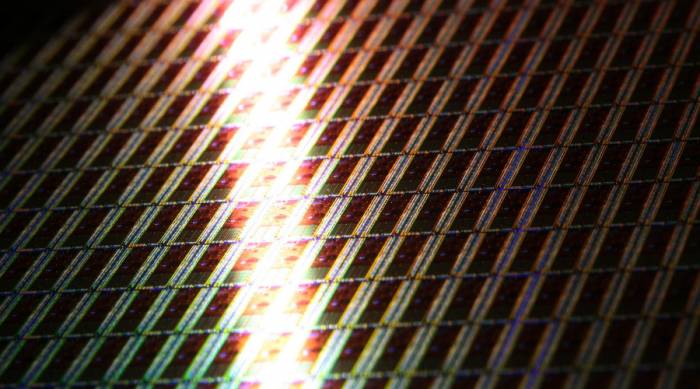

Silicon wafer manufacturers, a major offensive on 12-inch wafers

As a bulk category in semiconductor materials, more than 90% of semiconductor products are made using silicon wafers, so the market demand is huge. In 2021, the global shipment area of semiconductor silicon wafers reached 14.2 billion square inches, and the market size was as high as $14 billion. Although the current prosperity of the semiconductor industry is far from last year, the top five global silicon wafer manufacturers, including Shin-Etsu Chemical, SUMCO, GlobalWafers from Taiwan, China, Siltronic from Germany, and SK Siltron from South Korea, have been continuously making news.

The latest financial report of Shin-Etsu Chemical shows that from April to September, the revenue of Shin-Etsu Chemical's electronic materials business, which is centered on semiconductor silicon wafers, increased by 30.9%, and the operating profit increased by 34.3%. Faced with the significant increase in business volume against the trend, Shin-Etsu Chemical believes that in the semiconductor field, due to the strong demand centered on wafer foundries, its silicon wafers, photoresists, and other semiconductor materials are still being shipped to the maximum extent.

Nikkei News pointed out that Shin-Etsu Chemical's silicon wafers are mainly based on long-term contracts, so even in the volatile semiconductor market, profits are still stable. It is understood that most of Shin-Etsu Chemical's 12-inch products have contracts until 2027. Even if it is estimated that the industry will adjust before the first half of 2023, Shin-Etsu Chemical will still expand production capacity to cope with mid-term demand expansion.

It has to be said that Shin-Etsu Chemical is indeed very optimistic about the expansion of the semiconductor-related market. Its subsidiary, Shin-Etsu Polymer, will also expand the production of 12-inch wafer transportation containers. The news shows that Shin-Etsu Polymer invested about 10.5 billion yen to expand the construction of the Itoigawa factory, which is expected to be completed at the beginning of 2024. After completion, the production capacity of wafer boxes will increase by 40% compared to the current situation. Perhaps this is the strength and confidence of the global silicon wafer leader.

As for GlobalWafers and SK Siltron, South Korean media BusinessKorea reported that GlobalWafers will start building a factory in the United States next month. The factory in Texas is scheduled to start production in 2025, with an investment of $5 billion, and is expected to produce 1.2 million 12-inch wafers per month.GlobalWafers announced at its investor conference on November 1st that its third-quarter revenue reached a historical high of NT$18.053 billion, with customer prepayments also hitting a record high of NT$38.21 billion. GlobalWafers' Chairman Hsu Hsiu-lan stated that in the short term, the demand for computers, smartphones, and memory devices may be affected by a decline in consumer confidence levels, potentially leading to a continued weakness in the second half of the year. However, the automotive and data center sectors are showing strong performance, both adding growth momentum to the semiconductor industry. Additionally, governments around the world are actively planning energy transitions and policies related to net-zero carbon emissions, which are expected to continue driving demand for semiconductors and supporting the industry's long-term development.

SK Siltron, the only silicon wafer manufacturer in South Korea, has also decided to make a large-scale investment. According to reports, SK Siltron plans to invest 23 trillion won by 2026, expanding the facilities of its Gumi factory by 42,716 square meters. Construction of the new factory is expected to begin in November, with the goal of mass production in the first half of 2024. In fact, since March of this year, SK Siltron has invested 10.495 trillion won in the construction of a silicon wafer factory in the Gumi Industrial Park. In late September, its board of directors also resolved to invest 8.55 trillion won in the construction of a new factory to increase the production capacity of 12-inch silicon wafers, and even considered an additional investment of 4 trillion won next year. As for the reason for the additional investment, SK Siltron believes that although the current market conditions have deteriorated, the demand for semiconductors remains strong in the long term.

German Siltronic recently stated at its performance briefing that the expansion of its Singapore and Freiberg factories is proceeding as planned. It is understood that in the first nine months of 2022, Siltronic paid 585.6 million euros for capital expenditures, including intangible assets, focusing on investing in the construction of a new 300mm factory in Singapore and expanding the crystal pulling hall in Freiberg. Amid a strong US dollar and an increase in the pricing currency, Siltronic also raised its full-year sales guidance for 2022, expecting a sales increase of 26% to 30%.

Although Japan's SUMCO does not have the latest expansion plan, it does have the latest acquisition plan. On October 28th, SUMCO announced that it would acquire Mitsubishi Materials' polysilicon business for semiconductors, which specifically includes the Yokkaichi factory of Mitsubishi Materials that produces polysilicon, the US manufacturing subsidiary Mitsubishi Polysilicon USA, and the indispensable compound trichlorosilane manufacturing business for producing logic chips. SUMCO stated that this would allow it to create a one-stop silicon wafer production system.

In addition, Taiwan's silicon wafer factory, Xintec, in order to expand the 12-inch silicon wafer market, will continue to actively expand related production capacity. Not only will the monthly production capacity of the Zhengzhou factory double to 20,000 pieces, but a capacity of 30,000 pieces will also be established at the Longtan factory. It is expected that by 2023, the group's monthly production capacity for 12-inch silicon wafers will reach 50,000 pieces, an increase of four times the current 10,000 pieces.

In summary, the reason for the expansion of silicon wafer factories is that manufacturers believe that in the long term, the growth momentum of the semiconductor industry will continue to play a role. Although the PC and smartphone terminal product markets are in an adjustment situation, the demand from data centers and automotive continues to be strong.

Among them, 12 inches have become the main target for manufacturers' expansion. Siltronic expects the demand for 200mm and 300mm diameter wafers to remain strong in the fourth quarter. Sumco also predicts that the demand for 12-inch silicon wafers will grow from 8 million pieces per month in 2022 to 11.5 million pieces in 2026, with a CAGR of 9.4%. Sumco stated that the global 12-inch silicon wafer mainly relied on the expansion of existing factories before 2020, and the new factory gradually released production capacity after 2021. The peak of capacity release will be after 2024, so the overall industry supply capacity in 2022 and 2023 is limited, and the logic and memory 12-inch silicon wafers will continue to be in short supply.

The author believes that one of the reasons why silicon wafer manufacturers can expand with confidence is that the market is highly concentrated and the pattern is basically stable, with the top five manufacturers accounting for about 89% of the market share. In the past ten years, the large silicon wafer industry has experienced four major industry mergers and integrations, ultimately forming a competitive pattern of five dominant silicon wafer markets from more than 20 silicon wafer manufacturers in 1990. However, with various countries and regions elevating the semiconductor industry to a new strategic height, the difficulty of industry mergers and integrations has increased, such as the failure of GlobalWafers' plan to acquire German Siltronic.

The "big is big, strong is strong" effect has always existed in the semiconductor industry. Faced with an uncertain market situation in the future, further increasing the output and scale of silicon wafers is indeed a business strategy for industry giants to enhance their competitiveness and leading advantages.SiC Substrates, Automobiles Remain the Main Driving Force

The importance of SiC substrates to the SiC industry chain is no less than that of silicon wafers in the semiconductor industry, accounting for 50% of the entire SiC industry chain's value. The article "SiC Substrates, Global Massive Expansion" previously counted the expansion plans of domestic and foreign SiC substrate manufacturers from this year to the end of September, including overseas manufacturers such as Wolfspeed, Coherent (formerly II-VI), SiCrystal (acquired by Japanese Rohm), SK Siltron, Soitec, STMicroelectronics, as well as domestic manufacturers like Shandong Tianyue, Hefei Luxiao, Jing Sheng Electromechanical, Tony Electronics, Tianke Heda, Nansha Crystal, and others, with several substrate manufacturers embarking on the path of expansion. Even so, SiC substrate manufacturers remain very active recently.

The leading manufacturer Wolfspeed achieved a revenue of $241 million in the first quarter of the 2023 fiscal year, slightly exceeding the market expectation of $239 million, and achieved a year-on-year increase of more than 50% for two consecutive quarters. The main reason for this is the continuous improvement in the operation of power device business and the strong demand for 6-inch SiC substrates in the material business. In September, Wolfspeed announced the construction of the world's largest SiC material factory in Raleigh, North Carolina, to support the plan to increase the production of power equipment in the Mohawk Valley. Recently, Wolfspeed also pointed out that it is expected to spend $100 million in the 2023 fiscal year to start solving the problem of increasing capacity at the Marcy factory in New York.

Wolfspeed CEO Gregg Lowe said, "Wolfspeed has a huge momentum in more and more medium and high-performance applications. The design investment in this quarter is $3.5 billion, which is six times that of the same period last year, and the current opportunity pipeline has exceeded $40 billion." Wolfspeed believes that the opportunities for electric vehicles and the increasing popularity of SiC in the automotive and broader industrial markets have created a strong tailwind for their next-generation solutions, making them confident in their strategy when preparing to further invest in the business.

On October 5, STMicroelectronics officially announced that it will establish an integrated SiC substrate manufacturing factory in Italy to meet the growing demand. It is understood that this SiC substrate manufacturing factory, together with the existing SiC device manufacturing factory, is built at STMicroelectronics' Catania factory in Italy and will become the first factory in Europe to mass-produce 150mm SiC epitaxial substrates, which is expected to start production in 2023. Regarding the reason for expansion, STMicroelectronics pointed out that customers of SiC devices in automotive and industrial applications are transitioning to electrification and seeking higher efficiency.

In terms of Onsemi, its latest financial report shows that the revenue in the third quarter was $2.2 billion, achieving a record financial performance for the sixth consecutive quarter. President and CEO Hassane El-Khoury pointed out that although there is a weakness in the consumer and computing markets of non-strategic end markets, with a continuous decline in the mid-single digits, and it is expected that the weakness of these markets will continue to exist and extend to some traditional industrial fields, the demand and design activities for electric vehicles, ADAS, and energy infrastructure remain strong. It is reported that more than 30% of Onsemi's revenue comes from the sale of new products at an increased profit margin, and the new product revenue in the third quarter set a record for the company.

Regarding SiC substrates, Hassane El-Khoury emphasized the same outlook for the business, saying that since Onsemi began to disclose performance outlooks, the target has not changed. This year, Onsemi has increased the start-up rate of SiC wafer factories by three times to keep up with Boule production, and plans to double it next year, expecting to double the SiC revenue in 2022 and achieve a revenue of $1 billion in 2023 according to the commitment of LTSA. In the second quarter conference call, Hassane El-Khoury had pointed out that it is planned to double the substrate production year-on-year by the end of this year.

Overall, the hot market for electric vehicles is one of the main reasons for driving the expansion of SiC substrate manufacturers. Compared with the existing silicon products, the advantages of SiC devices, such as higher power, lower energy consumption, longer endurance, smaller loss, and lower weight, promote their potential to become the best-selling power devices in the future. As the most basic material for manufacturing SiC devices, SiC substrates will naturally have a broad prospect. Therefore, even if the overall industry is sluggish today, manufacturers will choose to expand against the trend in order to compete for the future market share.Power Semiconductors: Domestic Manufacturers in Relentless Pursuit

Power semiconductors are at the heart of power supply and electric power control applications, offering functions such as reducing on-resistance and enhancing power conversion efficiency. Compared to logic chip and memory chip manufacturers aiming to reduce capital expenditure, the expansion of power semiconductor manufacturers is particularly eye-catching, especially for domestic manufacturers who have ushered in a wave of intensive expansion.

Let's first briefly understand the recent expansion plans of overseas power semiconductors. The leader, Infineon, announced the construction of a new factory in Hungary; ON Semiconductor and STMicroelectronics are focusing on the field of silicon carbide power semiconductors; Japanese companies Fuji Electric and Hitachi Power Semiconductor have also increased the production capacity of power semiconductors...

Looking at the domestic front, in addition to the recent announcement of a 1.5 billion yuan investment by Silan Microelectronics to build a SiC power device production line, and the 10 billion yuan expansion of the power device project by CRRC Times Electric, the most popular recent topic is the official announcement by CR Micro that it will build a 12-inch production line in Shenzhen. At the end of October, CR Micro announced that the total investment scale of the CR Micro Shenzhen 12-inch line project is about 22 billion yuan, focusing on analog special processes above 40 nanometers, with products mainly applied in fields such as automotive electronics, new energy, industrial control, and consumer electronics. According to the Baoan Daily, on October 29, the construction of the CR Micro Electronics Shenzhen 12-inch integrated circuit production line project started, and after the completion of the project, it will form an annual production capacity of 480,000 12-inch power chips.

Similarly, the power device project invested in by CRRC Times Electric, with an investment of 10 billion yuan, has also started construction. On October 28, the Zhuzhou CRRC Times Power Semiconductor Device Core Manufacturing Industrial Park project started construction. Zhuzhou CRRC Times Semiconductor Co., Ltd. is a holding subsidiary of CRRC Times Electric. The project plans a total investment of more than 5.2 billion yuan, and after completion, it can add an annual production capacity of 360,000 8-inch medium and low voltage component substrates.

In addition, the domestic power semiconductor giant, Wingtech Technology, invested 3 billion yuan to expand its packaging and testing capacity. On October 25, Wingtech Technology announced that the "Nexperia (China) Co., Ltd. Packaging and Testing Factory Expansion Project Investment Agreement" has been signed, with a total investment of about 3 billion yuan, engaging in industries including but not limited to discrete devices, analog & logic ICs, power MOSFETs. Public information shows that Wingtech Technology's Shanghai Lingang 12-inch automotive-grade wafer project has fully started construction, mainly producing power semiconductors, and is expected to release mass production capacity in 2023.

Not only are manufacturers expanding, but power semiconductors have also become a key focus of cross-industry layout. Previously, the real estate company Emperor International acquired a total of 14.43% of the shares of Yifa Power, and later, Gaoxin Development planned to invest 63.8 million yuan to participate in the establishment of a power semiconductor merger and acquisition investment fund. It is reported that Emperor International also signed an agreement with the government of Dexing in July this year for a project to produce 240,000 high-end chips for new energy vehicles, and Gaoxin Development also officially entered the power semiconductor industry in the first half of this year by acquiring Senwei Technology and Chengdu Gaotou Senwei Semiconductor Co., Ltd.

As for why power semiconductors are so popular in such a sluggish environment, the analysis in "Power Semiconductors, Disbelieving Downturns" points out that there are three main reasons: First, the era of increasing automotive power semiconductors, with the explosive growth of new energy vehicles, the value and market size of power semiconductors have rapidly increased; second, IGBT is still in its infancy, with the electrification and intelligence of automobiles driving the automotive-grade IGBT to become the fastest-growing segment, far exceeding the industry average growth rate; third, the third-generation semiconductors are "flocking," with the characteristics of high voltage resistance, high-speed switching, and low on-resistance of the third-generation semiconductor devices, making them the best choice for high-performance device manufacturers, and it is precisely because of the popularity of the third-generation semiconductor power devices that the expansion of the above SiC substrate manufacturers has been accelerated.

"Going Against the Tide" LeadersCompared to the full-scale expansion of silicon wafers, SiC substrates, and power semiconductors, Samsung and Texas Instruments (TI) can be considered the rebels among rebels. While other companies in the storage and analog fields have successively broken through their defenses, these industry leaders have firmly chosen to continue investing.

However, from the perspective of industry volatility, storage chips and analog chips can be said to be completely opposite. As a weathervane for the semiconductor industry, the volatility of storage is stronger than the overall semiconductor market. In this downcycle of the semiconductor market, the storage industry has been hit the hardest, firing the first shot in reducing capital expenditure. In contrast, the volatility of analog chips is obviously weaker than the overall semiconductor market, and their resistance to downturns is well-documented.

Why do the leading companies in these two very different fields unanimously decide to firmly invest in their plans? The reasons are probably as follows:

For Samsung, Kyung-Hyun Kwee (transliteration), head of Samsung Electronics' semiconductor business, and Jin-Wan Han (transliteration), deputy head of Samsung Electronics' storage semiconductor business, have both firmly stated that Samsung Electronics will not waver due to industry conditions and will continue to invest without considering production cuts.

Samsung believes that if the market recovers, insufficient investment during the downturn may damage the business. In fact, during Samsung's growth history, there have been three counter-investments, and it is precisely these three perfect counter-investments that have allowed Samsung to rise from the ashes and dominate the semiconductor industry. This may also be one of the important reasons supporting Samsung's investment. The market's view is also the same; they believe that Samsung plans to use this industry downturn to leverage its capital advantage to encroach on the market share of other major manufacturers such as SK Hynix and Kioxia, and consolidate its industry leadership.

For Texas Instruments, TI has no plans to reduce capital expenditure or slow down the construction of new factories. Rafael Lizard, CFO of Texas Instruments, explained that because Texas Instruments' chips have a wide range of applications and a life cycle of several decades, and can even be stored in warehouses for up to ten years, the risk of inventory for most Texas Instruments' chips is very low. Ensuring more inventory has a "very high potential advantage," which is also the reason why the company is more willing to maintain high inventory in the current chip cycle.

The most notable features of analog chips are their long life cycle, variety, and weak cyclicality. As the leading manufacturer of analog chips, Texas Instruments has accumulated tens of thousands of product models, with tens of thousands of general models, and a more dispersed range of products, which makes it less susceptible to the impact of changes in a single industry's prosperity. Even if the prices of some products fluctuate, a large part of the chips can still ensure revenue. It must be admitted that this is indeed the source of confidence for Texas Instruments to expand production against the trend.

From this perspective, although the sources of confidence for Samsung and Texas Instruments to increase investment are different, the essence is the same, which is to ensure their leading position in the industry and try to expand market share through counter-investment.

In conclusion, the counter-cyclical period is very important for manufacturers. If they can fully understand the cycle and make good use of it, many things can be achieved with half the effort. The current complex external environment is accelerating the survival of the fittest in the industry, and the concentration of the semiconductor industry is accelerating. The reason why the giants in each field choose to invest and expand production at this time is that once they get through this one or two years of counter-cyclical period, when the semiconductor enters the upward cycle, they may be able to enjoy the dividends of counter-cyclical investment and further increase their market share in the industry.Without a doubt, it is now a critical juncture to seize the cycle well. Manufacturers should be better prepared for strategic planning. After all, the production capacity that permanently exits the market during the downturn will inevitably need "new players" to fill in the next prosperous cycle.

Comments